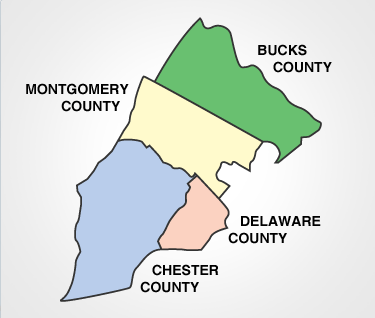

Suburban REALTORS® Alliance

News Brief Headlines

Scroll down for full text of articles

- Auditor General report says PA charters, cyber schools are overfunded

- SRA on Facebook and Twitter

- Gas drilling updates in Nockamixon

- Bensalem finalizes school budget

- Hulmeville Borough to consider zoning ordinance update

- Warwick to hold public hearing on public sewer connection ordinance

- Exton Square property owners win assessment appeal

- T/E passes new budget

- Kennett school board approves 2012-13 tax increase

- West Chester Area School District Realtor Summit Recap

- Delaware County Open Space, Recreation & Greenway Plan Survey

- Nether Providence approves bamboo ordinance

- Radnor tables Villanova University’s expansion plan

- Upper Chi tables rezoning ordinance

- West Norriton planners reject Westover Country Club sports complex plan

- Whitemarsh tackles storm water management

- Lower Merion School District passes 1.99 percent tax increase

- Upper Dublin approves 4.25 percent tax increase

- Limerick to consider amendment to streets and sidewalks curbs ordinance

- AVI delay could force revisions to city’s five-year financial plan

General

Auditor General report says PA charters, cyber schools are overfunded

A recent study released by Pennsylvania Auditor General Jack Wagner reports that the state’s formula for funding charter schools and cyber schools is “overly generous.” PA funding for charter and cyber schools uses a formula that is based on the educational costs of the sending school district instead of the actual educational cost for the charter school. Wagner said that PA taxpayers could save $1 million each day if charter and cyber tuition payments were more in line with national averages. The report states that PA charter schools spend an average of $13,411 per student, with the national average at $10,000. The state’s 13 cyber schools spend $10,415 per student on average and the national average is $6,500. Cyber charters receive the same amount per-pupil as charter schools that operate in buildings. Further, the cyber payments vary wildly depending upon the sending district – a cyber charter received an average of $16,915 for each Montgomery County pupil enrolled in 2010-11 and just $6,752 for one from Schuylkill County. Pennsylvania has 500 school districts, and therefore, 500 different rates to charters.

Source: Philadelphia Inquirer; 6/20/2012 & The Intelligencer; 6/21/2012

SRA on Facebook and Twitter

If you enjoy getting our weekly News Briefs, you may want to consider connecting with the Suburban Realtors Alliance on Facebook and Twitter. We put out regular information updates through both of these social media channels.

Bucks

Gas drilling updates in Nockamixon

As Nockamixon’s court battle against Act 13, the state’s natural gas drilling law, heads through the state court system, the community’s first natural gas drilling well remains on hold. The Pennsylvania Department of Environmental Protection (DEP) has temporarily halted the permit application of Turm Oil to drill an exploratory natural gas well on the former Cabot chemical property in Nockamixon. Once back on the clock, a decision on the drilling permit must be made in six days. However, if approved by DEP, the drilling will still be on hold as the township’s challenge to Act 13 remains active in the courts. Nockamixon and its partners allege that Act 13 strips away the constitutional rights of citizens and local municipalities by usurping local zoning laws that restrict gas drilling within municipalities.

Source: Courier Times; 6/18/2012

Bensalem finalizes school budget

The Bensalem Township School District school board finalized a 2012-13 school year budget that will increase the average taxpayer’s school property taxes by $64. The millage rate will rise from 141.4275 to 144.35 mills, with a mill equal to a tax of $1 for each $1,000 of assessed property value. A homeowner with a property assessed at the district average of $22,000 will pay $3,175 in school property taxes. Bensalem will use about $703,000 in uncommitted fund balance funds to cover a budget deficit.

Source: Courier Times; 6/14/2012

Hulmeville Borough to consider zoning ordinance update

Hulmeville Borough Council will hold a public hearing at 7:30 p.m. on Monday, July 2 at the Borough Hall, 321 Main St., Hulmeville, PA, to consider amendments to the Hulmeville Borough Zoning Ordinance. A comprehensive update of the Borough’s Zoning Ordinance from 1975 is proposed including: current practices in land use regulation; and local concerns and case law and amendments to the PA Municipalities Planning Code. A copy of the proposed ordinance may be examined, by appointment, at Borough Hall by calling 215-757-6531. A copy is also available at the Bucks County Law Library in the Bucks County Courthouse, Doylestown, PA.

Source: Courier Times; 6/7/2012

Warwick to hold public hearing on public sewer connection ordinance

The Warwick Township Board of Supervisors will hold a public hearing at 7:00 p.m. on Monday, July 2 at the township administrative offices at 1733 Township Greene, Jamison, PA 18929 to consider the adoption of an ordinance that will require mandatory connection to the public sewer system under certain conditions. Connection will be mandatory when a structure is within 150 feet of a public sanitary sewer line or when a connection is necessary for the public health, safety and welfare. The proposed ordinance will also set forth permit requirements, sewer rental charges and penalties for violations.

Source: The Intelligencer; 6/11/2012

Chester

Exton Square property owners win assessment appeal

Common Pleas Senior Judge Thomas Gavin ruled in favor of the Exton Square Mall’s appeal of its 2010-2011 property tax assessment, creating a possible long-term loss of revenue for the West Chester Area School District, which had argued against the appeal. Judge Gavin agreed with the mall’s real estate appraiser that the assessed value of the 39-year-old regional mall was $52.6 million, far below the Chester County Board of Assessment’s value of $62.5 million, and the school district’s calculation of $62.3 million. Gavin said in his decision that the district’s expert, Michael Samuels, had been too optimistic in his outlook for the future of the mall, noting he had not taken years of economic turmoil suffered by the Exton Square through business downturns and competition with the King of Prussia Mall complex into account. The lesser-assessed value rate would mean the school district would lose $180,000 or so in property tax revenues from the mall. The district would be forced to subtract the amount from its 2012-2013 budget, which the school board has already adopted. The county and West Whiteland Township, where the mall is located, will also see less revenue from the mall’s property tax bills, but at a lower cost than the district.

Source: Daily Times; 6/19/2012

T/E passes new budget

The Tredyffrin/ School Board approved the district’s 2012-13 final budget on June 14. The $125.8 million spending plan includes a property tax increase of 3.3 percent, which translates into an average annual increase of about $155 for a homeowner with an average assessment. According to the school board, the new budget will use $1.16 million from the district’s reserve fund, along with cost-cutting strategies and revenue enhancements totaling $1.4 million, to close an operating deficit. The board also approved the Homestead Exemption Real Estate Tax Credit, which will allow homeowners who filed a Homestead Exclusion form to receive tax relief from state gaming proceeds at an average of $177 on their 2012 property tax bills.

Source: Daily Local; 6/19/2012

Kennett school board approves 2012-13 tax increase

The Kennett Consolidated School District board of school supervisors approved the 2012-13 budget with the caveat that the district can’t continue down its current financial path much longer. The 3.89 percent increase in millage rates will increase the tax rate from 25.7293 to 26.7303 mills. A mill is a tax of $1 per $1,000 of assessed real estate value. That means homeowners will pay about $4,900 per year for a home valued at roughly $185,000, a $186 increase over last year. Reflecting on the board’s use of reserve funds over the past several years to balance budgets, Board member and Finance Committee Chairman Mike Finnegan said the district could not keep relying on those funds for much longer. Finnegan said recent reductions in federal support, coupled with tax reassessment appeals that have lowered property values throughout the county, have left Kennett schools as some of the most affected in the state.

Source: Daily Local; 6/15/2012

West Chester Area School District Realtor Summit Recap

The West Chester Area School District held its second Realtor Summit last week to highlight information that may be of interest to real estate professionals in the area. Superintendent James Scanlon gave an overview of the district’s accomplishments in a presentation. The district currently boasts the lowest millage rate in the county (18.36 mills). Scanlon also noted the newly updated Realtor Resources page on the district’s website, which includes a link to a school boundary map. Immediate Past President of the Pennsylvania Association of Realtors Guy Matteo provided an overview of current industry trends. It should be noted that fair housing complications may arise from providing information about schools or school districts. Best practice is to wait for the client to ask about the schools or school district and then direct the client to this or a similar website. (It is permissible to give the information without being asked, however to avoid possible steering claims, the agent would need to be very careful to give the information toevery prospect for that area or house).

Delaware

Delaware County Open Space, Recreation & Greenway Plan Survey

The Delaware County Planning Department, in association with the Parks Department, is currently developing the county’s Open Space, Recreation, and Greenway Plan. The plan will examine all parks and recreation in the county, including municipal and county parks, public and private open space, and trails. Delaware County residents are encouraged to take the survey below to help guide the planning for future parks, recreation, and open space projects and policies that aim to improve quality of life and enhance recreation opportunities in the county. The responses will help planners to know the recreational preferences of county residents, their experiences with the county Parks system, and their opinions on actions the county could take in the coming years in regards to these matters. https://www.surveymonkey.com/s/delcoparks2012. The survey will be open between May 31 and July 4, 2012.

Nether Providence approves bamboo ordinance

An ordinance taking aim at unchecked bamboo growth in Nether Providence Township is now on the books. Officials said they were motivated to act on the issue after an increasing number of cases in which bamboo plants — one of the heartiest and most difficult invasives to eradicate — were expanding into the yards of neighbors. Under the ordinance, when the township receives a complaint about the encroachment of any bamboo plant or root onto another property, or when officials spot it themselves, notice will be given to the landowner or tenant to remove the offending bamboo plant or root system. The notice will state specifically what must be done, with a fix required within 30 days. If the work is not performed, the township would have the right to carry it out and bill the property owner. With respect to new bamboo plants, precautions must be taken to prevent their rampant spread. Also, all bamboo plants must be located, trimmed and maintained so that no part of the vegetation is closer than 10 feet from any property line.

Source: Daily Times; 6/18/2012

Radnor tables Villanova University’s expansion plan

Radnor commissioners tabled a request from Villanova University for a zoning amendment that would pave the way for three new dormitories to house 1,160 undergraduate students, a 1,800-space parking garage, and a 450-seat performing-arts center, among other structures, on two campus parking lots on Lancaster Avenue. Nicholas J. Caniglia, an attorney representing the university, agreed to meet with the township administration to answer questions about the project, the size of which concerns residents and township officials. The university’s request to establish a new comprehensive integrated zoning district on campus involves raising the building-height limit to 65 feet (it is 38 feet now); no limit on height for rooftop structures such as elevator housings and antennas; zero front-yard setbacks, which are now at 120 feet; and the elimination of side- and rear-yard setbacks, which are now at 75 feet. Board members were concerned such a far-reaching amendment would eventually be sought after by the township’s other colleges. Residents attending the meeting also wanted more opportunity to gain insight into how the expansion plan would impact surrounding neighborhoods.

Source: Daily Times; 6/20/2012

Upper Chi tables rezoning ordinance

Upper Chichester Commissioners tabled a proposed ordinance that would rezone several parcels of land in the township. The proposed plans would square off a parcel of land from McCay Avenue to Meetinghouse Road, between Chichester Avenue and Third Avenue, converting the tract to a commercial designation. Another parcel of land from Meetinghouse to Okiola Avenue between Chichester Avenue and Third Avenue would be split between commercial and residential designations. A third tract of land from Clements Avenue to Meetinghouse Road, starting at Chichester Avenue, would be rezoned from an R-2 (medium-density) to an R-3 (high-density) residential designation. The commissioners fielded questions from residents about what the zoning changes would mean for the future of the properties on the land. The commissioners will consult the Delaware Valley Regional Planning Commission and consider the matter at their next business meeting on July 12.

Source: Daily Times; 6/19/2012

Montgomery

West Norriton planners reject Westover Country Club sports complex plan

The West Norriton Planning Commission unanimously rejected a proposed sports complex plan for the Westover Country Club property. A residents’ group opposed to the plan, Neighbors United, presented a 47-page “people’s brief” that contained legal arguments about an open space deed restriction on the property, an FAQ section, a May 4 critique letter from the Montgomery County Planning Commission, many letters of opposition and aerial views of an existing similar facility, the United Sports Training Center, in West Bradford Township. Developer VRJ Associates had requested approval for a plan to convert the country club into a sports complex with five soccer fields, 12 tennis courts, five baseball fields, five basketball courts, two swimming pools, a football field/eight-lane track, three tot lots, two picnic pavilions, six golf-course holes and a skate park. The developer’s plan will now go before the West Norriton Board of Commissioners. Click here for the township website and meeting information.

Source: Times Herald; 6/18/2012

Whitemarsh tackles storm water management

Whitemarsh Township supervisors are in the early stages of a plan that would allow the township to acquire flood-prone properties from residents who are not eligible for federal relief. The policy would be shaped by Act 153 of the Conservation and Land Development Act, which allows municipalities to purchase properties to be used for “open space benefit.” An affected property owner would need to apply to the township for consideration of township acquisition after there has been multiple documented flooding incidents at the property. Whitemarsh is also requiring future development to have a storm water management plan in place prior to building.

Source: Times Herald; 6/18/2012

Lower Merion School District passes 1.99 percent tax increase

The Lower Merion Board of School Directors recently approved a 2012-13 school year budget that includes a 1.99 percent tax increase. The new tax rate of 23.4841 mills will amount to an additional $114 in taxes on the average home assessed at $250,000 in the district. The tax hike is the lowest in the school district in 11 years.

Source: Main Line Times; 6/13/2012

Upper Dublin approves 4.25 percent tax increase

The Upper Dublin School Board approved the 2012-13 budget with a 4.25 percent tax increase. The increase will mean an additional $225 in school property taxes on a home assessed at the district average of $192,000. The total tax bill will district-average properties will be $5,526, and property owners eligible for the homestead exemption will receive a $304.60 credit on the bill.

Source: Ambler Gazette; 6/15/2012

Limerick to consider amendment to streets and sidewalks ordinance

The Limerick Township Board of Supervisors will consider an amendment to the township code that will require a property owner to install sidewalks and curbing on their property at the sole expense of the property owner after receiving notice from the Limerick Township manager. A full copy of the ordinance is available for public review at the township building during regular hours. A public hearing will be held on June 19, 2012 at 7:00 p.m. in the Limerick Township Municipal Building, 646 West Ridge Pike, Limerick, PA. Click here for the township website.

Source: Pottstown Mercury; 6/12/2012

Philadelphia

AVI delay could force revisions to city’s five-year financial plan

The city’s fiscal watchdog informed the Nutter administration that if the mayor’s proposed property tax overhaul is delayed, the city needs to revise their five-year-financial plan. Sam Katz, board chairman of the Pennsylvania Intergovernmental Cooperation Authority, said that if the move to a property tax system based on market values – known as the Actual Value Initiative (AVI) — is held up by City Council, the city should rewrite the five year plan based on the assumption that the current tax system remains in place. Katz said that it’s not prudent for the administration to count on Council approving AVI in the future. Finance Director Rob Dubow said such a rewrite would require the city to project cuts in future years, given the expectation of costly appeals without AVI. He said it was too soon to say exactly how that would play out. Of course, if Council does approve AVI for the 2013-14 fiscal year, as they currently are pledging, then many of those cuts would likely be a non-issue.

Source: Philadelphia Daily News; 6/19/2012

As an agent who’s an expert in this local area, I bring a wealth of knowledge and expertise about buying and selling real estate here. It’s not the same everywhere, so you need someone you can trust for up-to-date information. I am eager to serve you. Here are some of the things I can do for you:

As an agent who’s an expert in this local area, I bring a wealth of knowledge and expertise about buying and selling real estate here. It’s not the same everywhere, so you need someone you can trust for up-to-date information. I am eager to serve you. Here are some of the things I can do for you: